Construction a Quantitative Method for forecasting the Surplus Immediately Prior To Ruin in Risk Management

تفاصيل العمل

Abstract:

Scientific and practical research focusing on the ruin model, probability distributions, risk-based supervision (RBS), and surplus immediately prior to ruin in insurance companies.

Purpose – The study aimed to estimate the surplus immediately prior to ruin as an indicator warning of the company.

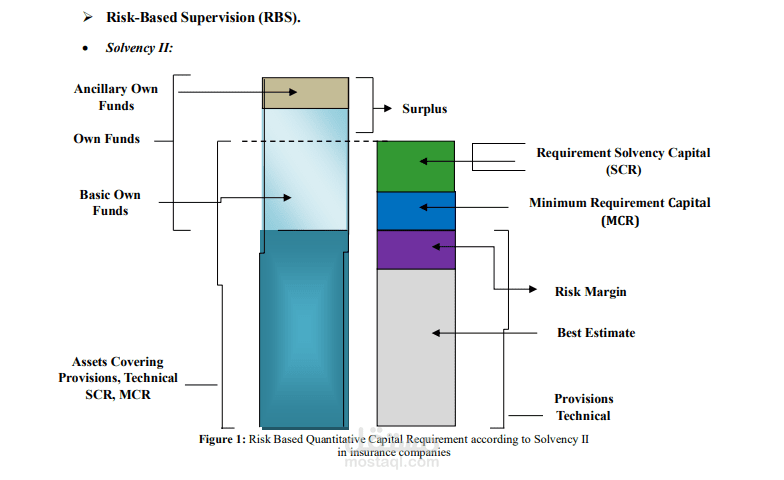

Design/methodology/approach – according to the evolution of the curriculum oversight, and using both the Classical

Risk Model (CRM) under the Solvency II policy according to the Method of Moments (MOM), the Classic Regression

Model (CMR) under the Solvency I policy according to the method of least squares (LSM), In order to compare the

estimated values of the two models in real terms to determine the most accurate and realistic in estimating equation

surplus, especially since there are many criticisms of the model of multiple regression as based on a set of assumptions

are, in fact, to simplify the actual reality, and are the most

important the assumption that the independent variables in the model of the equation are random and fixed in contrast to the practical reality that the Explanatory variables are stochastic,

and using (SPSS) software, (Easy Fit 5.6 Professional Evaluation Version) to test the validity of the study

hypotheses.