Bank Data Warehouse Schema

تفاصيل العمل

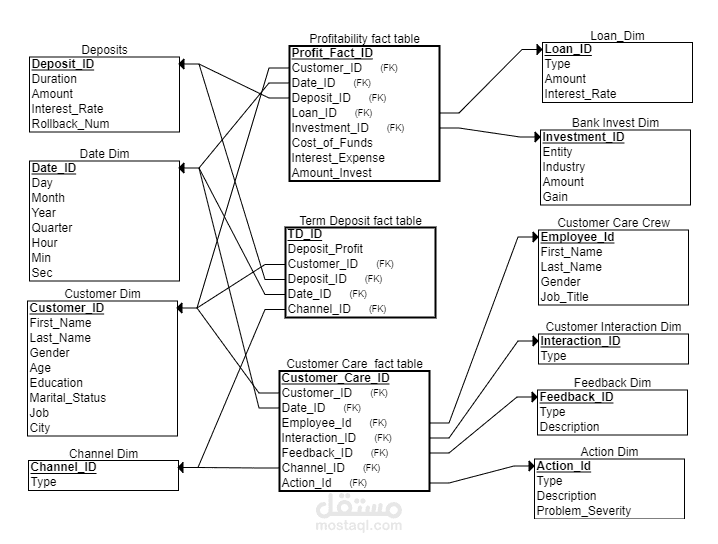

Building a data warehouse schema for the Bank Marketing term deposit project involves creating a star schema and using SQL querying and data cleansing techniques to transform and load data from multiple sources into the data warehouse.

The analysis should focus on the bank's term deposit system to ensure good ongoing business processes. The marketing department wants to analyze the behavior of customers who invest in term deposits. The analysis should include the demographic profile of customers, their investment amount, the duration of their investment, the interest rate offered, and how often they roll over their term deposits.

The finance team is interested in analyzing the profitability of the term deposit system. They want to know the cost of funds, the interest expense, and the net interest margin. The team also wants to analyze the impact of changes in interest rates on the profitability of the term deposit system.

The analysis shall also include the customer interaction process, which includes opening a term deposit account, depositing funds, and withdrawing funds. The bank's customer care team interacts with customers to handle inquiries, complaints, and feedback. The analysis should include the interaction type and problem severity (if any issue exists) for each customer interaction.

In addition, the bank wants to analyze the channel of interaction, such as online, phone, or in-person. Overall, the analysis should provide insights into the behavior of term deposit customers, the profitability of the term deposit system, and the customer interaction process. This information can help the bank make data-driven decisions to improve their term deposit offerings and customer service.