GOVI Dashboard

تفاصيل العمل

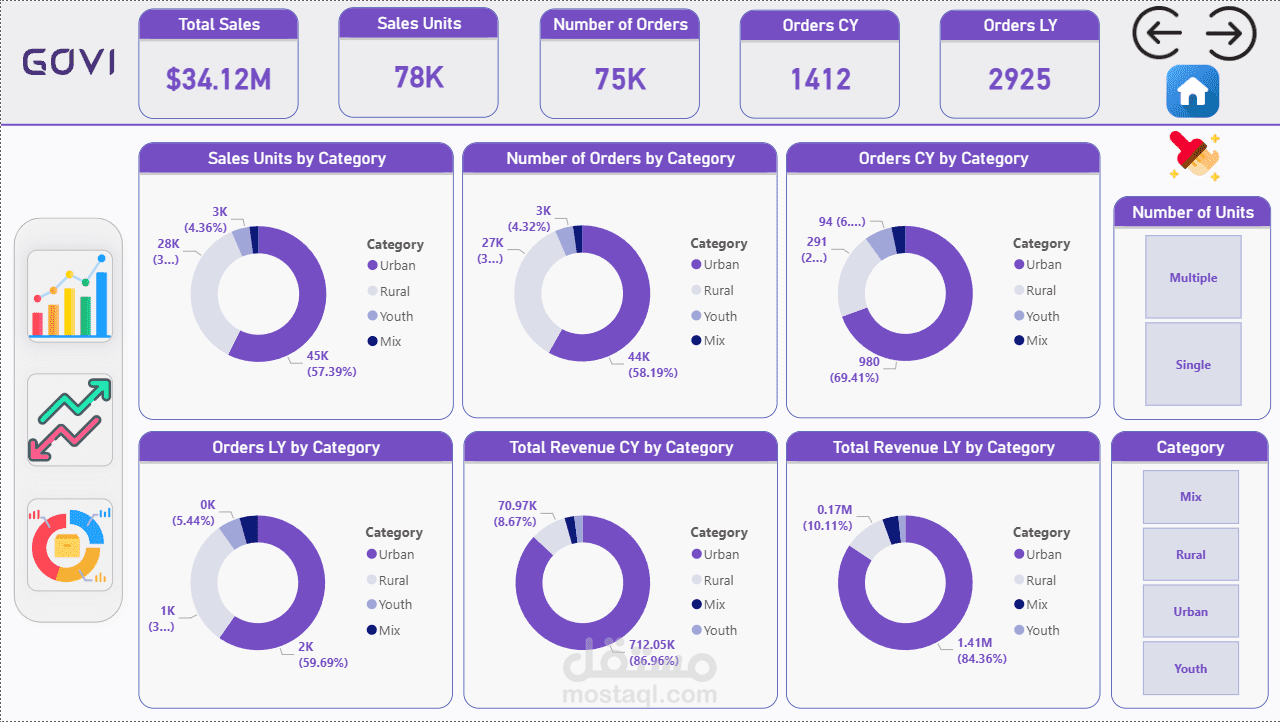

Executive Performance Report: GOVI Sales Analysis

1. Executive Summary

The organization has generated $34.12M in total revenue over the reporting period (1999–2015). The data indicates a business that reached a maturity peak around 2007 but has since entered a significant decline phase. Current Year (CY) performance is trailing Last Year (LY) across major metrics, indicating a need for urgent strategic intervention. The revenue stream is heavily reliant on a single category ("Mix") and two specific provinces (Ontario and Alberta), representing a high concentration risk.

2. KPI Snapshot (Cumulative)

Total Revenue: $34.12M

Total Volume: 78K Units

Total Orders: 75K

Average Order Value (AOV): $452.97

Average Price Per Unit: $439.59

Orders Trend (CY vs LY): Significant drop from 2,925 (LY) to 1,412 (CY), representing a ~51% decrease in order volume.

3. Deep Dive Analysis

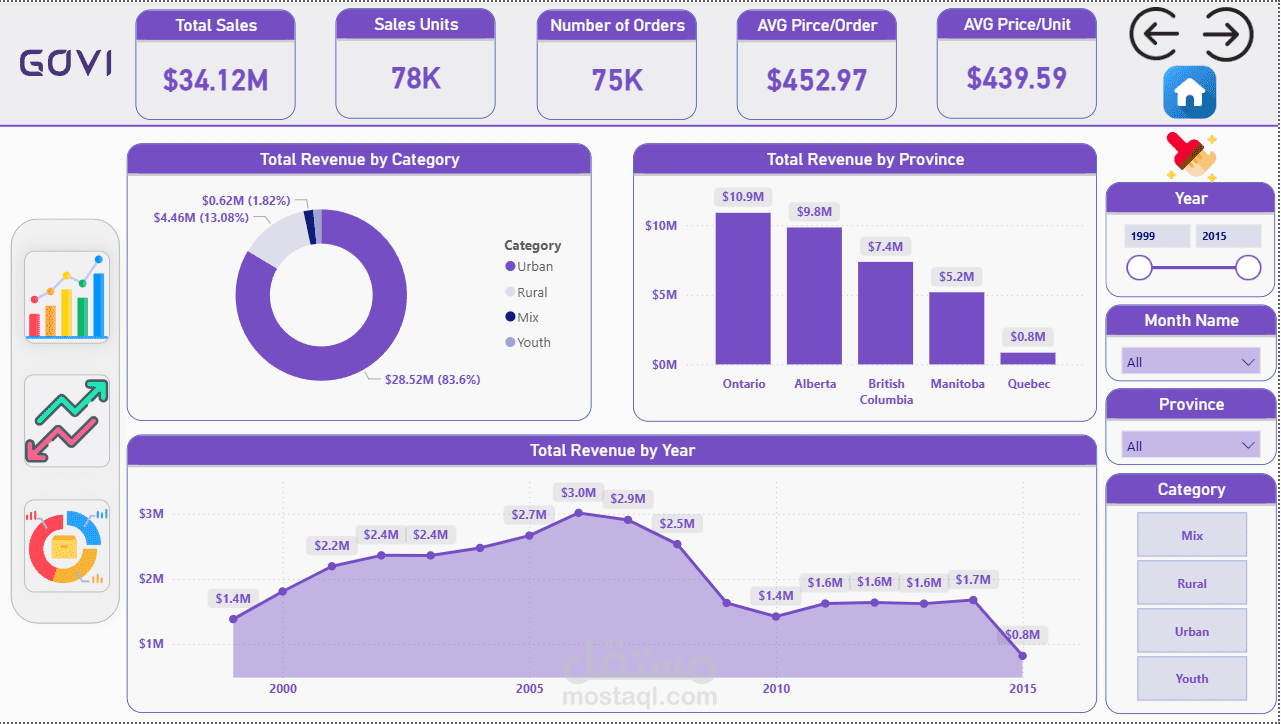

A. Category Performance (The Pareto Issue)

Dominant Category: The "Mix" category is the overwhelming revenue driver, contributing $28.52M (83.6%) of total revenue and roughly 57% of sales units.

Underperformers: The "Urban," "Rural," and "Youth" categories combined make up less than 17% of revenue.

Insight: The business is dangerously dependent on the "Mix" category. Any supply chain disruption or market shift affecting this specific category would be catastrophic to the bottom line.

B. Geographic Distribution

Top Performers:

Ontario: $10.9M

Alberta: $9.8M

Quebec: $0.8M

Insight: Ontario and Alberta combined account for over 60% of total revenue. Quebec represents a significant untapped market opportunity or a region where product-market fit has failed.

C. Temporal Trends (Time Analysis)

Long-Term Trend: Revenue peaked between 2005 and 2007 (reaching ~$3.0M/year). A sharp decline began in 2008, bottoming out in 2010 ($1.4M). A slight recovery occurred in 2012-2013, followed by a continued drop into 2015 ($0.8M).

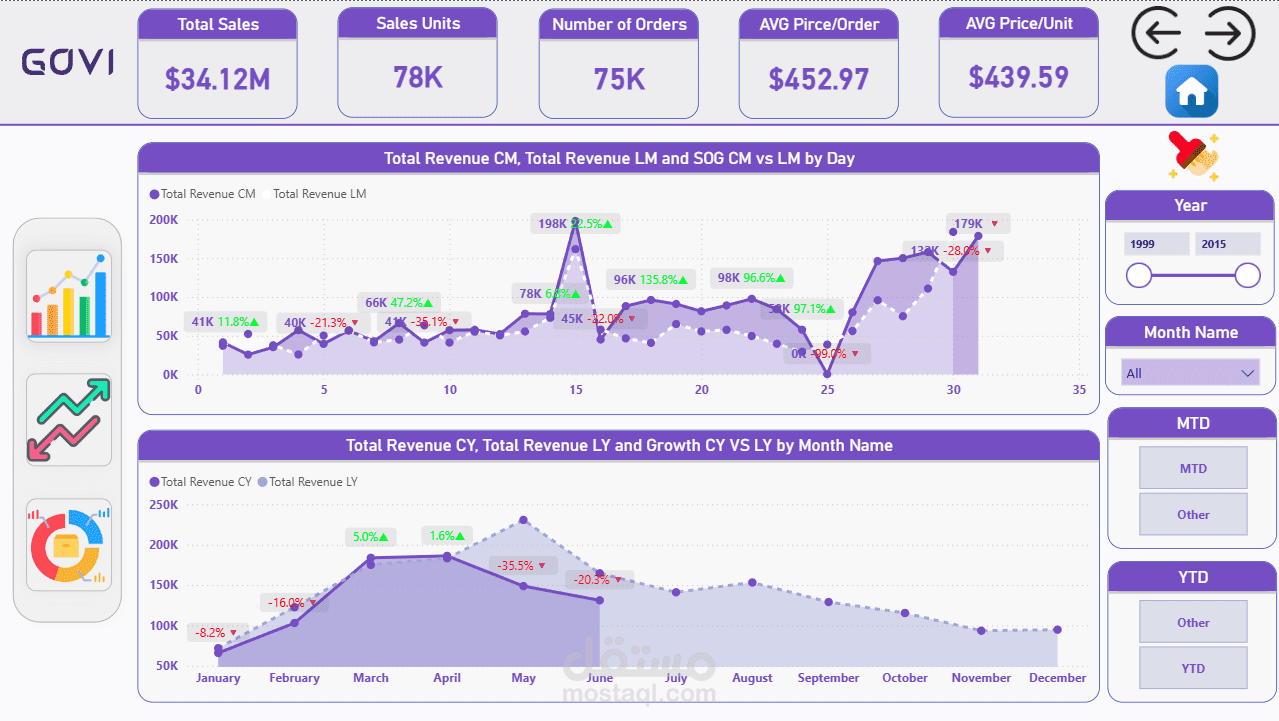

Year-over-Year (YoY) Performance:

The "CY vs LY" chart shows consistent underperformance.

May Performance: A gap of -35.5% compared to the previous year.

June Performance: A gap of -20.3%.

Daily Volatility: The daily chart shows high volatility, with spikes (up to +135%) followed immediately by sharp drops, suggesting inconsistent sales flow or sporadic large orders rather than steady recurring revenue.

4. Strategic Recommendations

Diversification Strategy: The reliance on the "Mix" category (83.6%) is a critical risk. Immediate R&D or marketing efforts should focus on boosting the "Urban" and "Youth" segments to balance the portfolio.

Investigate the 2008-2010 Crash: Analyze historical data to understand what caused the >50% revenue drop during this period (Economic factors? Competitor entry? Product change?) to prevent the current 2015 slide from mirroring that crash.

Regional Expansion: Investigate why Quebec ($0.8M) is performing so poorly compared to neighbors Ontario ($10.9M). Is this a language barrier in marketing, a logistics issue, or a cultural preference?

Customer Retention: With Orders dropping from 2,925 (LY) to 1,412 (CY), the company is losing customers rapidly. Implement a retention campaign or loyalty program immediately to stem the bleed.