Company Bankruptcy Prediction

تفاصيل العمل

This project builds a predictive model to assess whether companies are likely to go bankrupt, based on historical financial and accounting data. The aim is to provide a tool that can help stakeholders (investors, regulators, management) anticipate financial distress, enabling preventive actions.

Goal

- Predict bankruptcy risk for companies using their financial/accounting features.

- Achieve good predictive performance (accuracy, precision/recall, possibly AUC) so that the model is useful in practice.

- Use a public dataset (from Kaggle) of historical company financials for years like 1999-2009 from sources such as the Taiwan Economic Journal.

Approach

- Data Collection & Preprocessing

- Use a dataset of company financial metrics over multiple years, with labels indicating whether the company went bankrupt.

- Clean data: handle missing values, outliers, scale features.

- Possibly reduce dimensionality if many financial features are correlated (e.g. via PCA) or select features.

Model Development

- Experiment with machine learning classifiers: for example logistic regression, decision trees, random forests, gradient boosting machines, support vector machines, etc.

- Possibly do hyperparameter tuning (cross-validation) to find optimal model parameters.

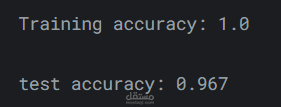

Training & Validation

- Split dataset into training and validation / test sets to avoid overfitting.

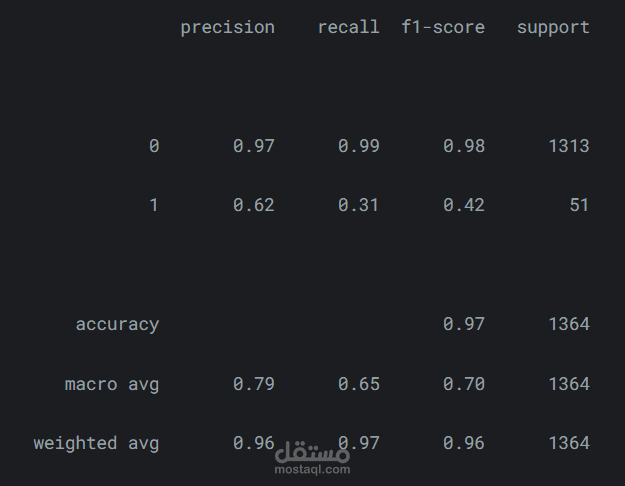

- Use metrics relevant for imbalanced data (if bankruptcy cases are much fewer than non-bankruptcy) such as recall, precision, F1-score, ROC-AUC.

Evaluation & Interpretation

- Evaluate model performance (accuracy, precision, recall, AUC etc.).

- Possibly analyze feature importance — which financial/accounting variables are most predictive of bankruptcy risk.

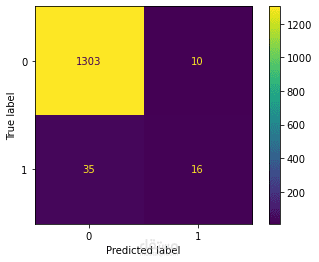

- Examine confusion matrix to understand errors (false positives vs false negatives).

Outcomes

- A predictive model capable of distinguishing companies that will go bankrupt vs those that will not, with good performance.

- Insights into which financial indicators are most strongly associated with bankruptcy.

- A working demonstration of risk prediction using public data, which could be adapted or extended to other economic/sector contexts.