Corporate Finance Model – WACC & Cash Flow Analysis in Excel

تفاصيل العمل

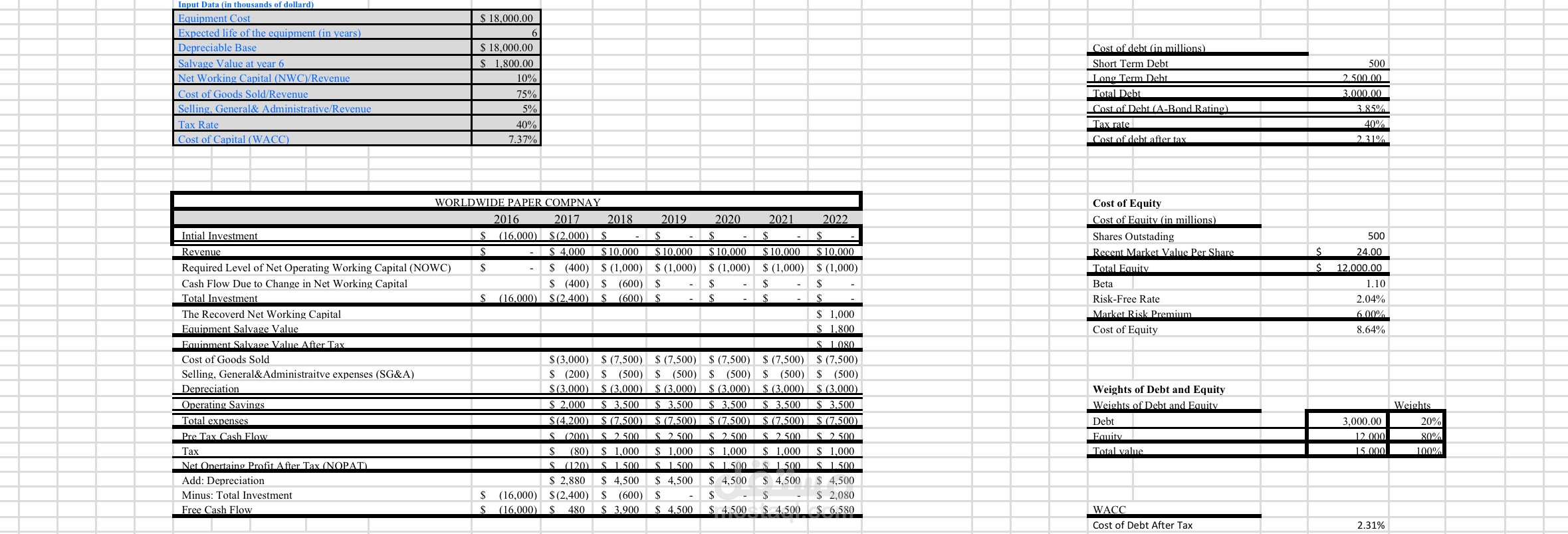

This model demonstrates Excel-based financial analysis. It covers Weighted Average Cost of Capital (WACC) calculation, cost of debt and cost of equity breakdown, and forecasting of revenue, expenses, and free cash flows. It includes depreciation, tax, and working capital adjustments, with structured input and output sections for clarity.

I can create customized corporate finance models, including valuation, investment appraisal, and cash flow analysis.