tesla stock prices(time series)

تفاصيل العمل

Tesla Stock Time Series Analysis & Forecasting

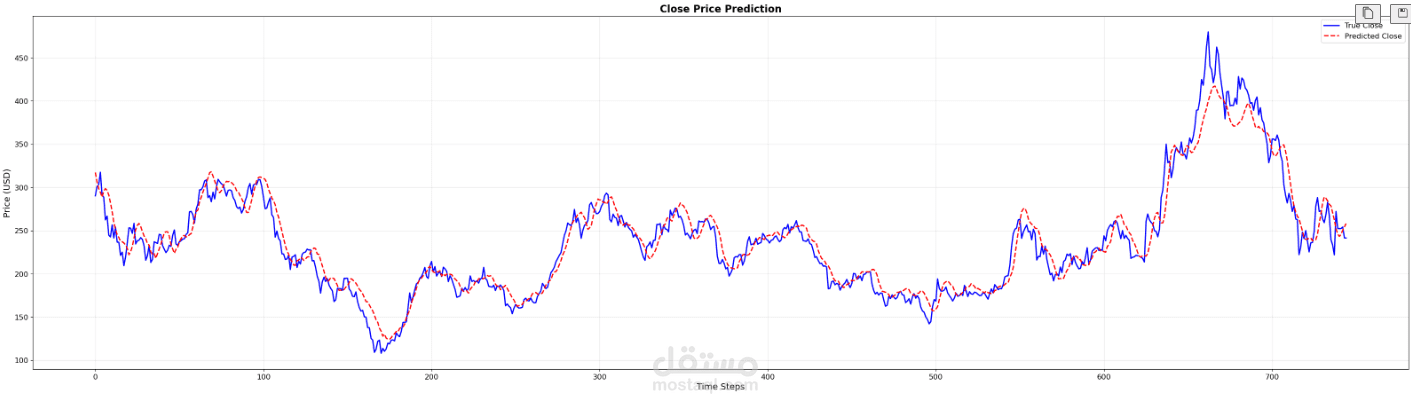

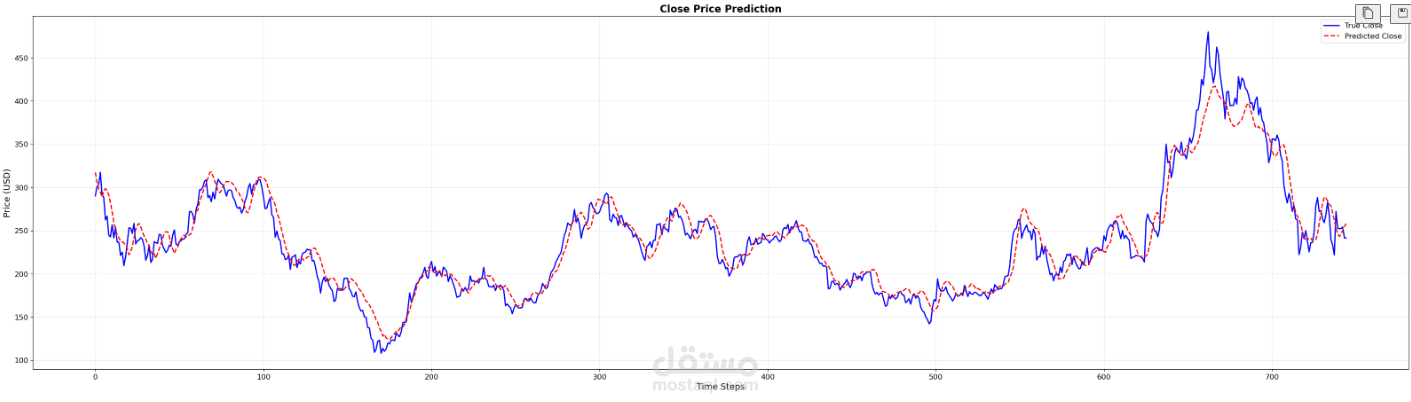

This project applies time series modeling and deep learning techniques to analyze and predict Tesla (TSLA) stock prices.

Key Features

Dataset: Tesla daily stock data (Open, High, Low, Close, Volume).

Exploratory Analysis:

Visualization of historical price trends.

Moving averages (SMA, EMA).

Volatility analysis.

Models:

Traditional: ARIMA, SARIMA for statistical forecasting.

Machine Learning: Random Forest, XGBoost for regression on time-dependent features.

Deep Learning: LSTM / GRU networks for sequential forecasting.

Evaluation Metrics: RMSE, MAE, and R² for prediction accuracy.

Visualization: Interactive plots of real vs predicted prices.

Workflow

Data Collection (e.g., from Yahoo Finance API).

Preprocessing: handling missing values, scaling, and feature engineering (lags, rolling averages).

Model Training: comparing statistical, ML, and deep learning models.

Forecasting: short-term (1–5 days) and long-term trends.

Deployment: Flask/Dash/Streamlit web app for interactive forecasting dashboard.

Applications

Stock market trend prediction.

Investment decision support.

Research in financial time series modeling.