Company Comparable Valuation

تفاصيل العمل

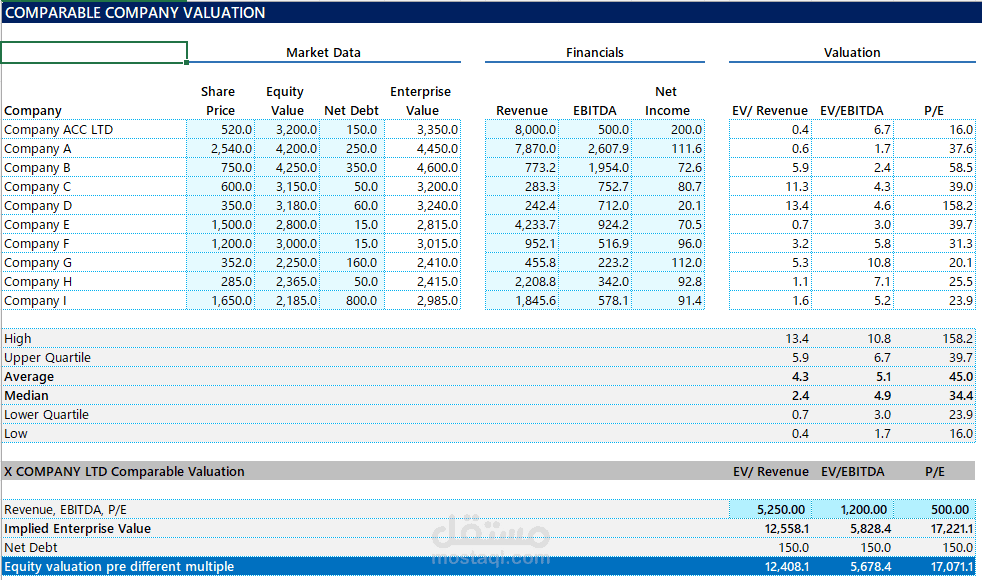

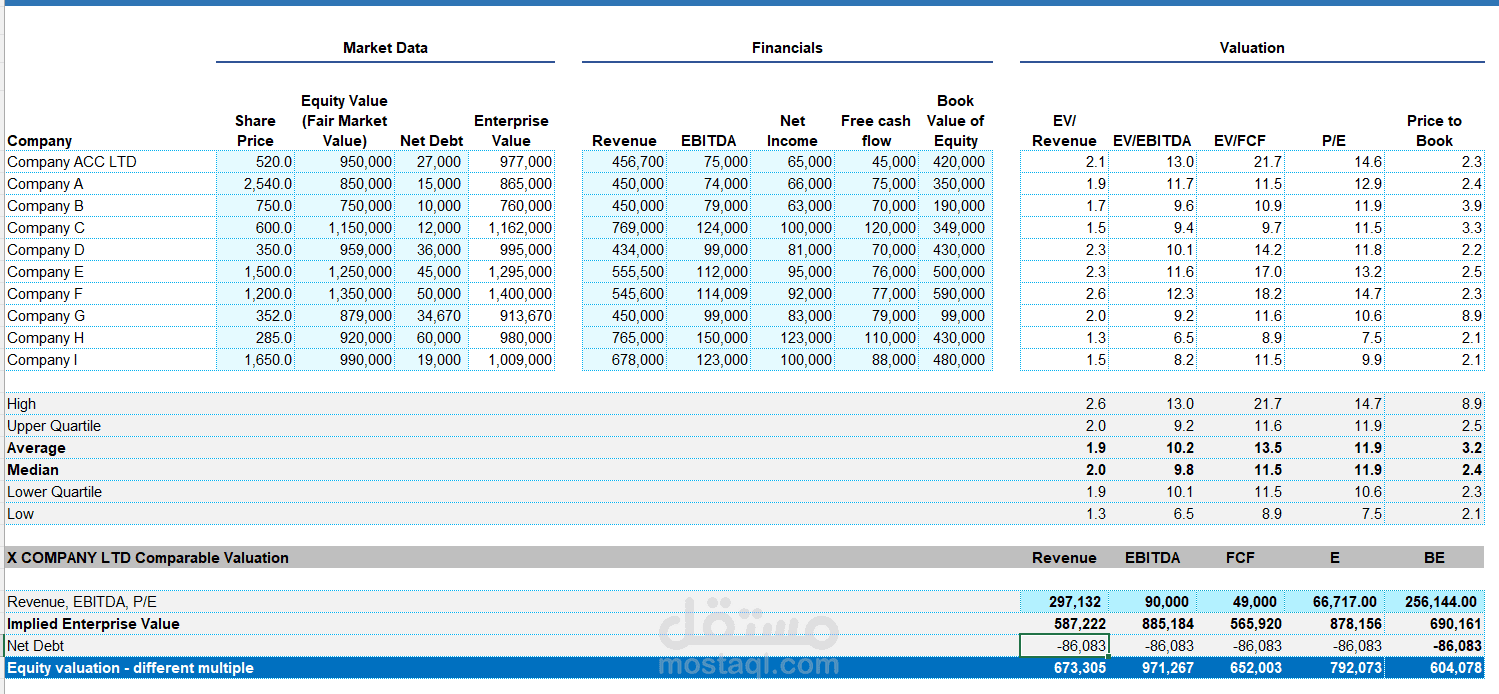

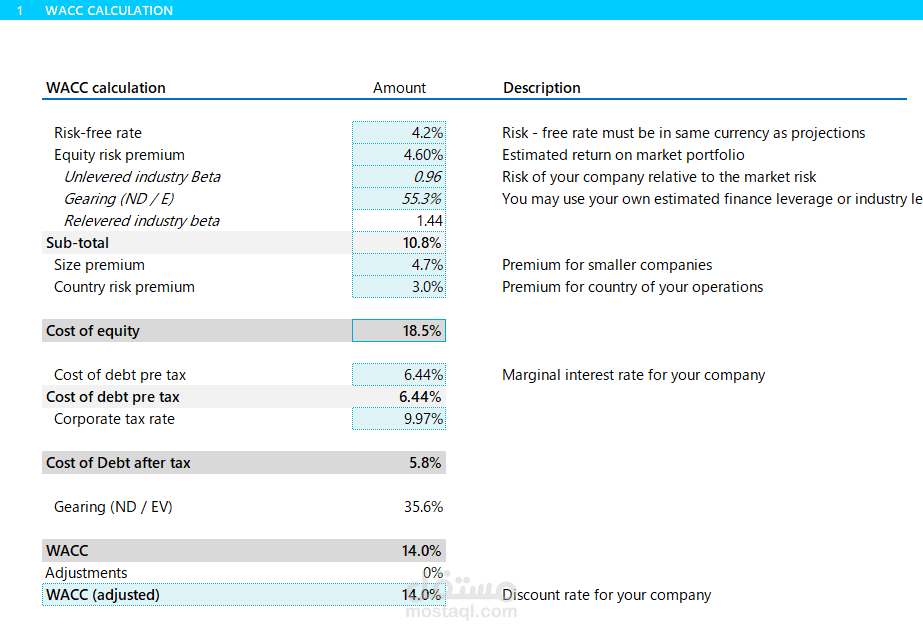

Conducted a Comparable Company Valuation to estimate the fair market value of a business by benchmarking it against similar publicly traded companies. The analysis included:

- Identifying relevant peers based on industry, size, and geography

- Collecting key financial metrics: Revenue, EBITDA, Net Income, etc.

- Calculating valuation multiples such as EV/EBITDA, EV/Sales, P/E

- Applying median/average multiples to target company metrics

- Sensitivity analysis for different valuation scenarios

This approach supported investment decisions and strategic planning, and was presented to senior management as part of an M&A or investment evaluation.

Tools Used: Excel, Financial Databases (if applicable)

Skills: Valuation, Corporate Finance, FP&A, Financial Modeling