Amazon Stock Price Analysis

تفاصيل العمل

This project analyzed historical stock price data for Amazon (AMZN) from 1997 to 2023 to understand trends, patterns, and key events that impacted its stock performance. The goal was to extract meaningful insights and provide a comprehensive understanding of how external factors influenced the company's stock prices.

What I Did:

Data Preparation:

Imported and cleaned the dataset, which included columns such as Date, Open, High, Low, Close, Adj Close, and Volume.

Ensured date formats were consistent and created additional features like daily price changes and moving averages.

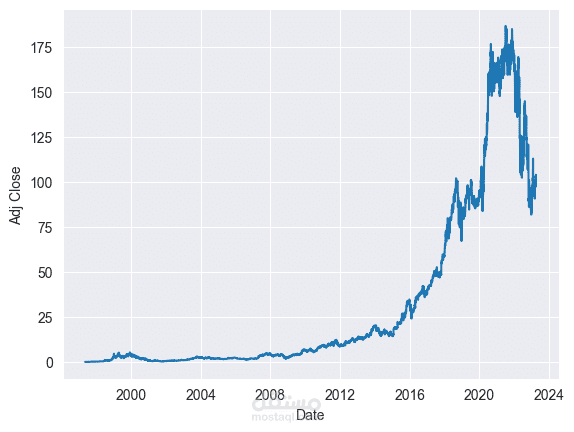

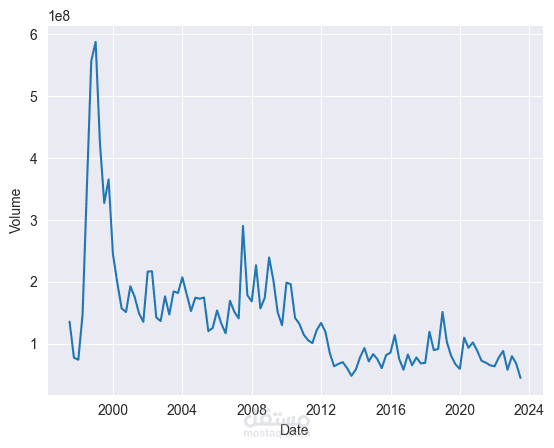

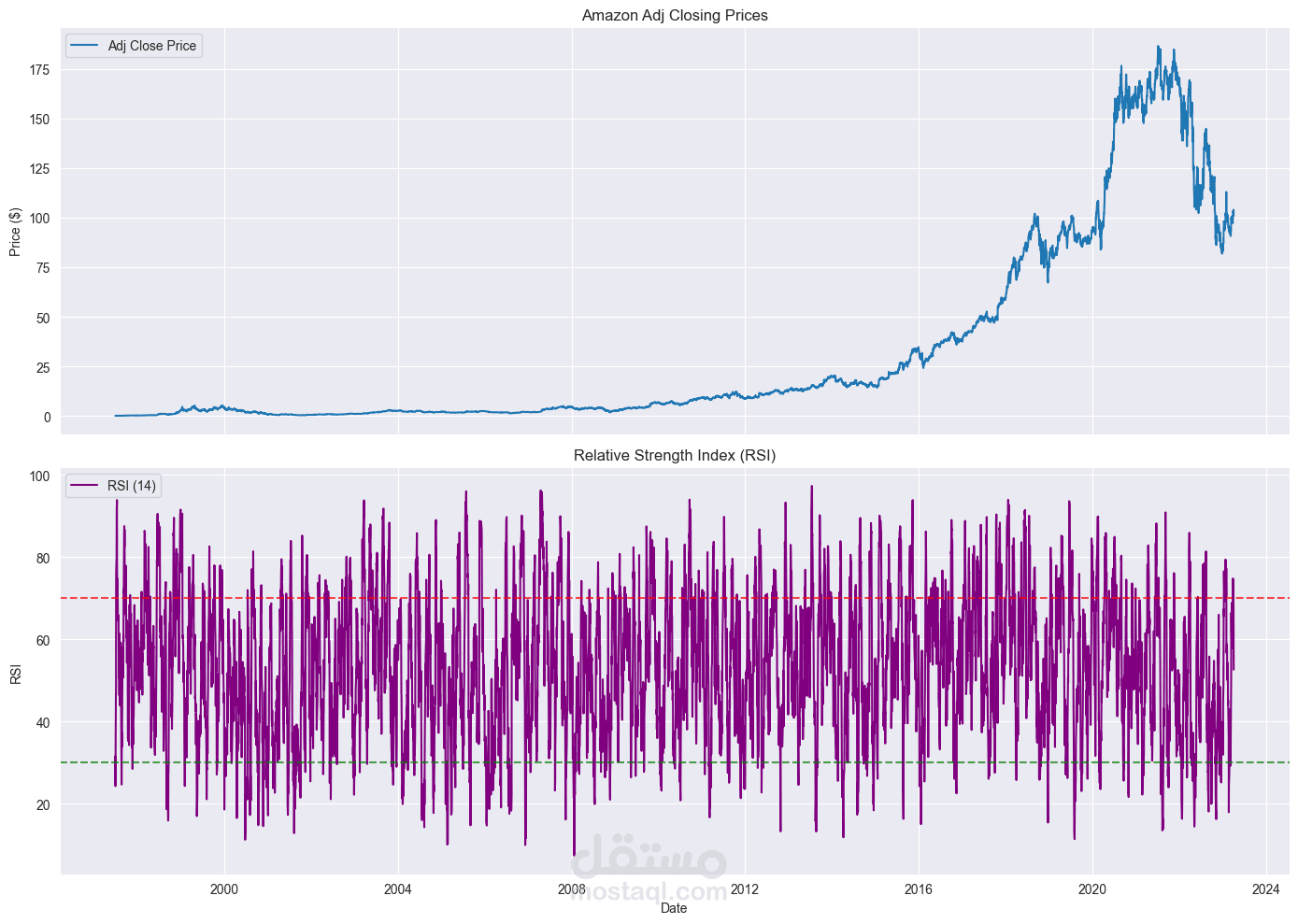

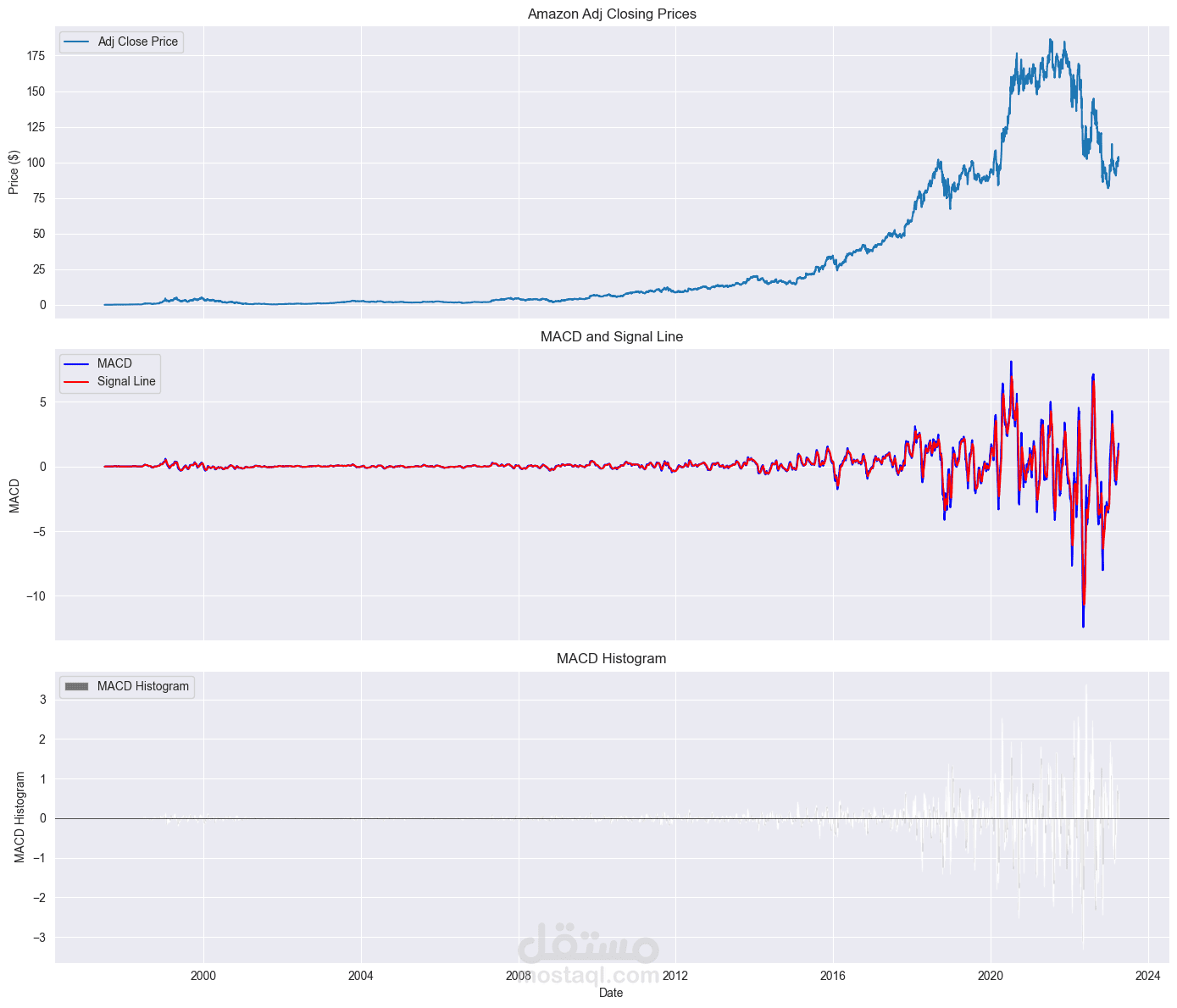

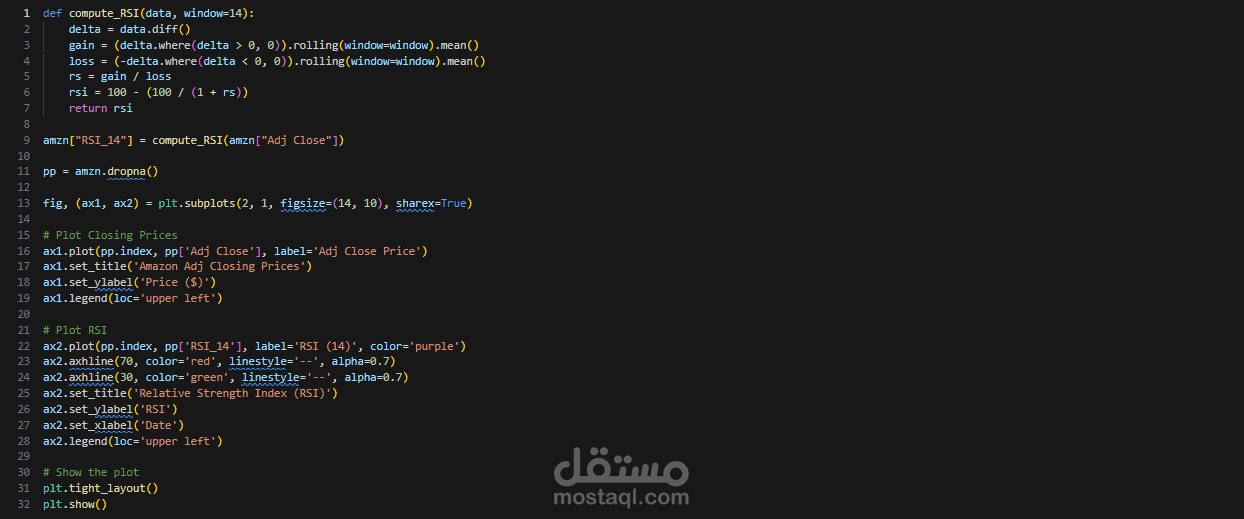

Exploratory Data Analysis (EDA):

Visualized stock trends over the years using line and candlestick charts.

Analyzed key metrics such as volume trends, yearly returns, and periods of high volatility.

Correlation Analysis:

Investigated the relationship between trading volume and price changes.

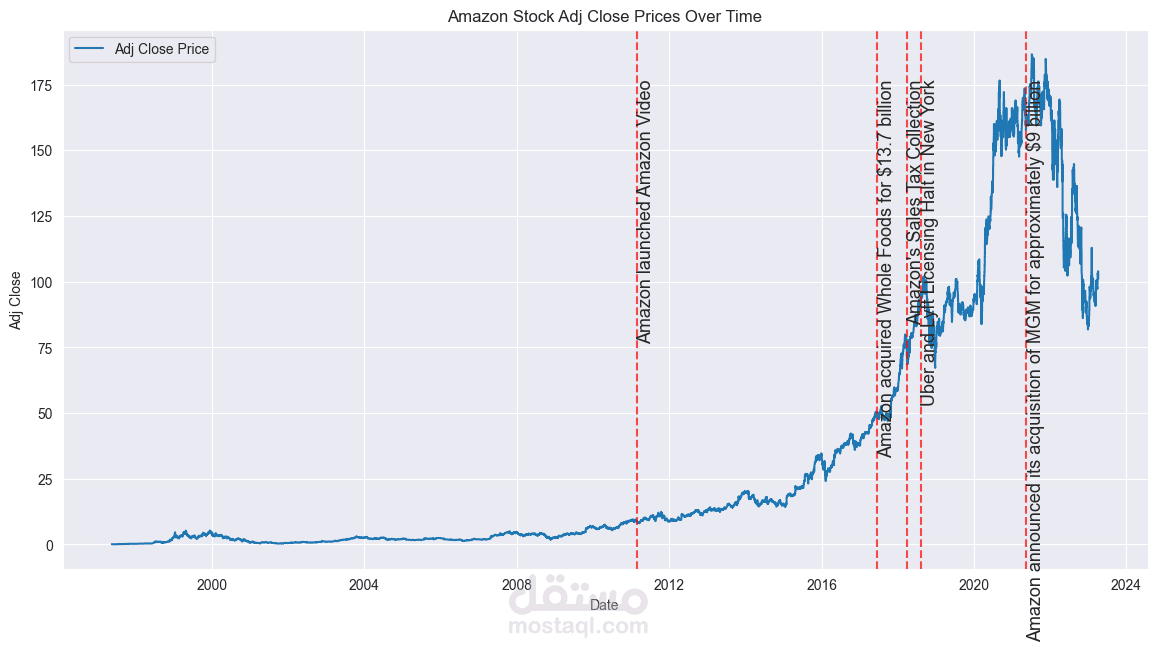

Identified patterns during significant market events, such as the 2008 financial crisis, COVID-19 pandemic, and Amazon's major announcements.

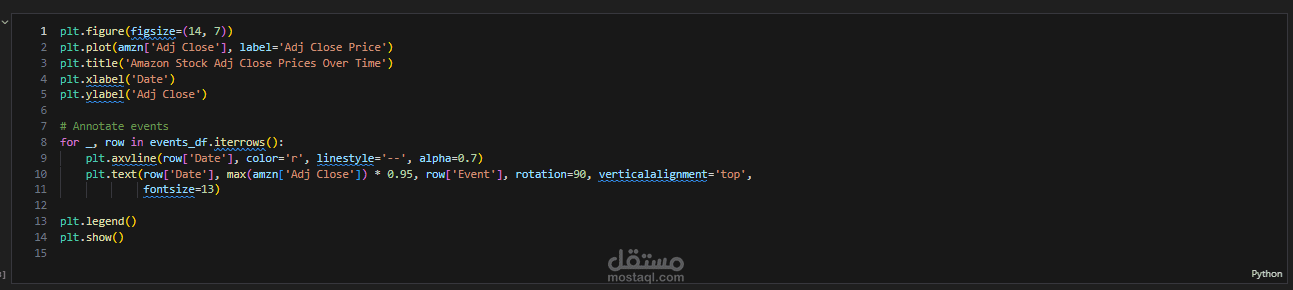

Event Analysis:

Mapped stock price movements to key events like product launches, earnings reports, and acquisitions (e.g., Whole Foods, MGM Studios).

Used this analysis to highlight how external factors impacted investor behavior and stock performance.

Predictive Modeling:

Developed a basic predictive model using machine learning algorithms (e.g., Linear Regression) to forecast future prices based on historical data and trends.

Tools and Technologies Used:

Python (pandas, NumPy, Matplotlib, Seaborn, and Scikit-learn)

Financial libraries for advanced analysis .

Jupyter Notebook for coding and reporting.

Results and Insights:

Demonstrated how specific events like AWS growth announcements and the COVID-19 pandemic influenced Amazon's stock price.

Provided actionable insights on long-term stock trends, helping to understand investment patterns.