تداول

تفاصيل العمل

Presentation title: Financial market analysis to guide investment strategies*

### introduction

Thank you for giving me the opportunity to make this presentation. This presentation aims to review the steps and methods used to accurately analyze the financial market, with the aim of improving investment strategies and increasing the company's financial returns.

### the goal

Providing a comprehensive analysis of the financial market that can be relied upon to make informed investment decisions and reduce the risks associated with trading.

### Analysis plan

1. *Data collection:*

- *Economic data:* We will collect basic economic data such as gross domestic product, unemployment rates, inflation, and interest rates from reliable sources.

- *Market data:* Obtain historical data about asset prices, trading volumes, and technical indicators from financial databases.

2. *Fundamental analysis:*

- *Company Analysis:* Study the financial reports of target companies, including balance sheets, income statements, and cash flows to evaluate the companies’ financial health.

- *Economic news:* Follow up on economic news and financial reports to determine events affecting the markets.

- *Sector Analysis:* Evaluating the performance of different sectors to identify promising sectors for investment.

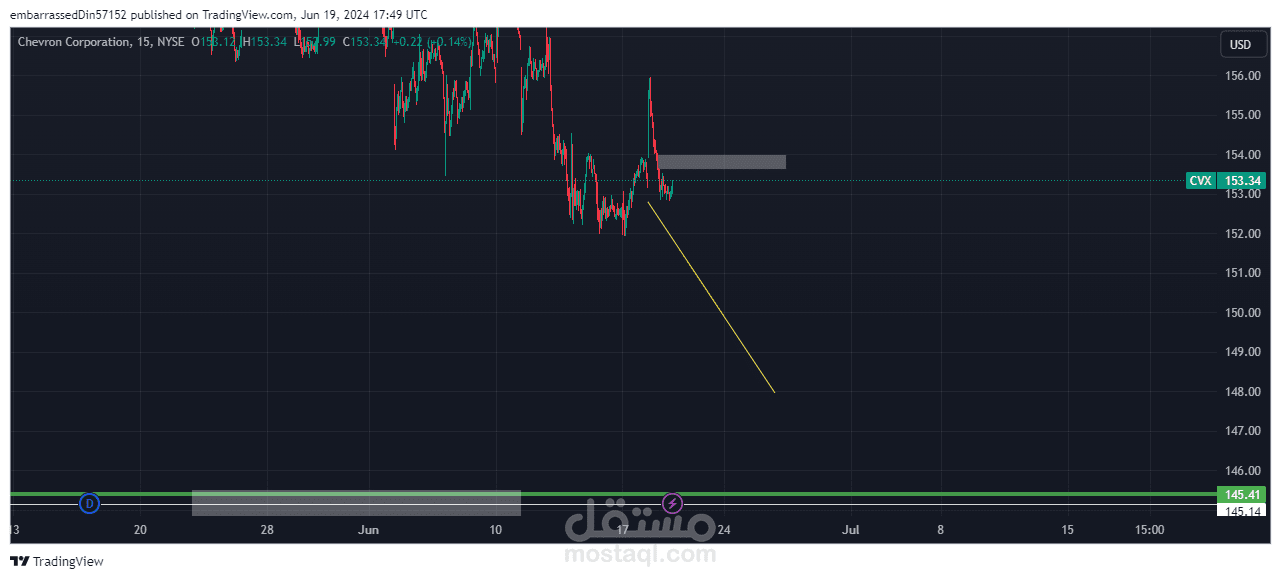

3. *Technical analysis:*

- *Charts:* Use charts to analyze price patterns and determine future trends.

- *Technical indicators:* Applying technical indicators such as moving averages, the relative strength index (RSI), and the MACD indicator to determine entry and exit points.

- *Support and Resistance:* Determine support and resistance levels to evaluate potential reversal points.

4. *Statistical models:*

- *Predictive models:* Using predictive models such as regression and temporal analysis to anticipate future trends.

- *Volatility Analysis:* Evaluating price fluctuations using models such as GARCH to understand the risks associated with trading.

5. *Risk management:*

- *Portfolio diversification:* Distributing investments across various assets to reduce risks.

- *Stop orders:* Apply stop loss and profit orders to manage open positions.

- *Scenario Analysis:* Evaluating the impact of different scenarios on the investment portfolio.

6. *Performance review:*

- *Periodic evaluation:* Regularly review the performance of investments and modify strategies as needed.

- *Error analysis:* Analyze unsuccessful trades to avoid mistakes in the future.

### Conclusion

By following these steps and methods, we can provide a comprehensive analysis of the financial market, which helps in making informed investment decisions and increasing the company's financial returns. I look forward to discussing this presentation in more detail and answering any questions you may have.

Thank you for your time and interest.