Loan Approval Prediction Model

تفاصيل العمل

This project predicts whether a loan application will be approved based on applicant details.

It applies Machine Learning models such as:

Logistic Regression (baseline)-

Logistic Regression + SMOTE (to balance data)-

Decision Tree Classifier (tuned hyperparameters)-

-----------------------------------------------

Project Workflow:

Data Exploration & Cleaning – inspected data types, missing values, and separated categorical & numerical features-

Feature Preparation – encoded variables like education & self_employed, and scaled numerical features-

Model Training – trained Logistic Regression, SMOTE-enhanced Logistic Regression, and Decision Tree-

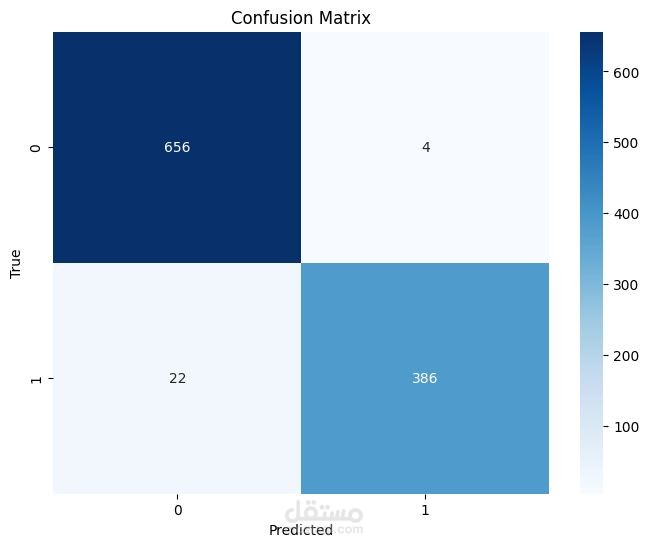

Evaluation – compared models using Precision, Recall, F1-score, and Cross-validation with focus on business context-

(false positives are riskier).

-----------------------------------------------

Results:

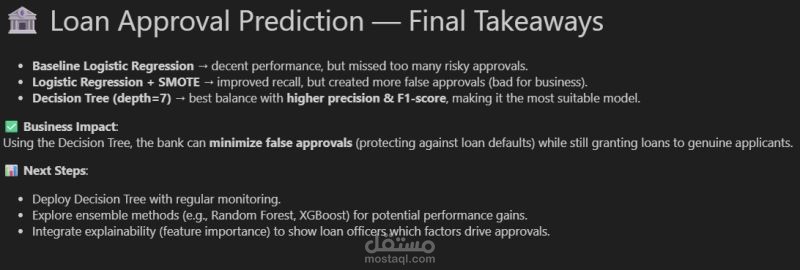

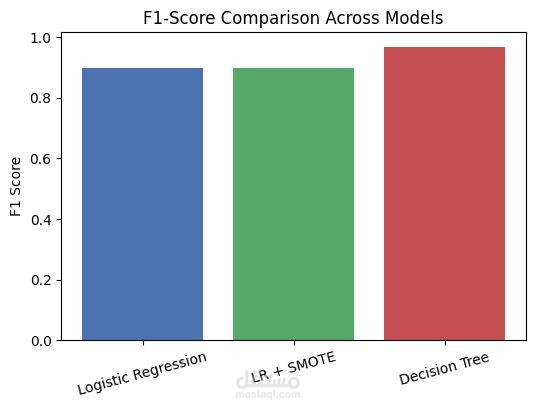

- Logistic Regression → Precision: ~0.88 | Recall: ~0.91 | F1: ~0.89 | CV: ~0.89

- Logistic Regression + SMOTE → Recall improved (~0.94) but added more false positives

- Decision Tree Classifier → Precision: ~0.99 | Recall: ~0.94 | F1: ~0.97 | CV: ~0.97 ⭐

Final Choice: The Decision Tree achieved the best balance, with high precision and recall-

-----------------------------------------------

Business Impact:

The model helps banks minimize false approvals (reducing risk of defaults) while ensuring genuine applicants still receive loans.

-----------------------------------------------

Tech Stack:

Python | Pandas, NumPy | Matplotlib | scikit-learn, imbalanced-learn (SMOTE)